This manufacturer’s customers take advantage of a large number of post-invoice discounts related to rebates and promotional activities.

Accounts Receivable Automation

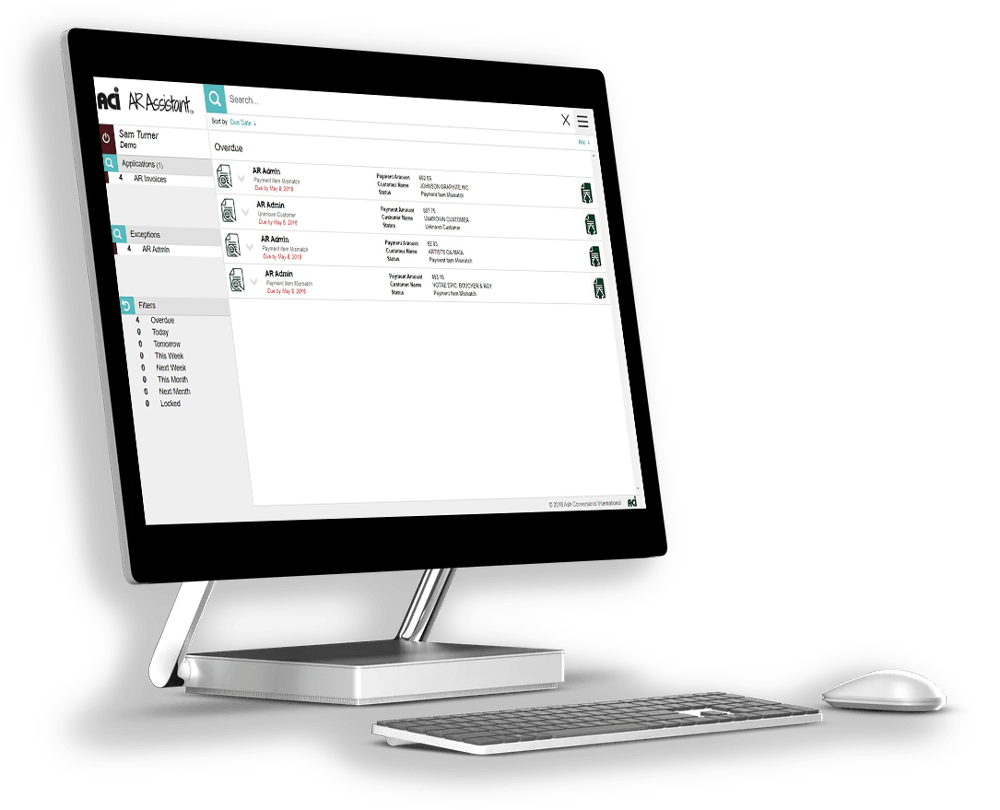

Accelerate Your Cash Flow With AR Assistant™, ACI's Accounts Receivable Workflow Automation Solution For Cash Application Process

ACI’s AR Automation solution for Cash Application process increases efficiency by automatically processing payments with a touchless rate upwards of 95%. This will help your organization to reduce your DSO by a minimum of one week and improve your cash management, allowing you to reclaim valuable time and money.

Optimizing accounts receivable is one of the key principles of efficient capital management and is crucial to your organization’s cash flow. If your organization is still manually applying cash remittances against outstanding accounts receivable invoices, you are spending two to three times more money and resources than if you were using an automated process.

ACI’s AR automation specialists, with over forty years of experience providing customers with solutions for document and data-driven business processes, will help your organization implement and streamline your AR cash application process, increasing staff efficiency while generating significant reductions in costs.

Optimize Your AR Cash Application Process with an Automated Solution Customized for Your Organization

Implementing Accounts Receivable Automation in your organization with ACI’s cloud cash application software is simple and straightforward. As experienced Business Process Automation specialists, our team of professionals work with you step-by-step throughout the implementation to have you operational in as little as 30 days.

The end-to-end automation of the cash application process in accounts receivable provides:

- Remittance advice handling from multiple sources & formats (hardcopy, digital, EDI)

- Payment linking

- Invoice matching

- Coding of deductions, rebates & credits

- Automated handling of preauthorized / automatized bill payments

- ERP Posting

- Seamless interfacing with any contemporary ERP platform

With ACI’s AR Assistant™ solution, your organization will:

- Increase the efficiency of your cash applications by automating manual AR steps

- Reduce the amount of time required to process payments against customer invoices

- Generate a clear ROI from process efficiency gains

- Eliminate hardcopy document handling and storage

- Eliminate error-prone manual data entry and wasted time

- Improve handling of remittance processing, customer deductions, rebates and credits

- Increase your invoice payment speed - get paid faster

- Gain valuable AR insights with management reports and other measurable data

- Eliminate compliance & financial risk by partnering with ACI, a CSAE 3416 SOC certified service provider, employing best practices

- Achieve improved team productivity

- Improve your customers’ experience, drive repeat sales and get faster customer payments

Here are some of the ERP’s ACI’s solution has interfaced with: SAP, Microsoft Dynamics GP, Oracle, PeopleSoft, JD Edwards, Lawson, Baan, Sage 300 (formerly Accpac), 4th Shift, Capp Auto, Yardi

Increase Your Overall Efficiency with ACI's AR Automation Software to Reduce Costs

Positively impact your bottom line, get paid sooner and streamline your AR payment processing by transitioning to AR Assistant™ – ACI’s Automated Accounts Receivable Process:

- Benefit from a 25% Reduction in past due receivables (Source: Paystream Advisers)

- Reduce DSO by 40% (Source: Aberdeen Group)

- Improve cash flow forecasting by 45% (Source: Aberdeen Group)

- Reduce losses from bad debt and collection expenses by 29% (Source: Aberdeen Group)

- Improve transaction efficiency by 19% (Source: Aberdeen Group)

- Eliminate costly manual data entry errors. An Institute of Financial Operations study identified that AR automation increases your department’s efficiency by reducing the number of tedious tasks resulting in fewer critical errors

Implement AR Automation in your organization and eliminate manual, labour intensive processes, significantly reducing your AR workload so your employees can refocus their time on more strategic tasks.

Introducing Remote Deposit Capture

Maintain Uninterrupted Cash Flow In A Remote Workplace Environment

In addition to automating your payment remittance processing, you can optimize your cash flow to a greater degree by further reducing your Days Sales Outstanding (DSO) with CheqMate™, our new Remote Cheque Deposit solution. By adding CheqMate™ to your AR Automation process, you will gain access to your funds, sooner. Simply have your cheque payments directed to your organization’s lockbox at our secure Document and Data processing facility and we’ll do the rest. We receive and open your cheque mail, scan the cheques, capturing the image and relevant data, and then electronically deposit your payments directly into your account at your preferred financial institution. This cuts several days from a manual process, allowing your staff to work remotely – getting your organization’s money into your account much quicker while providing a more positive cash flow to run your business more effectively.

Transition to a Hybrid Workplace with AR Automation

Many people around the world find themselves working from home or remotely, and doing so requires the right setup. If you’re like many organizations, and are considering continuing to offer your employees the option to work remotely, you will want to consider ACI’s AR automation solution.

Several organizations have already experienced the many benefits of processing AP invoices by implementing accounts payable automation, and have recognized the need to automate their AR processes as well.

No matter the size of your organization or the volume of your payments transactions, automating your Accounts Receivable processes will provide you with a viable solution for business continuity in the remote workplace.

Accounts Receivable Automation FAQ

ACI’s AR Assistant™ is a comprehensive workflow solution that automates cash application across all remittance and payment formats and is designed to replace manual processes increasing organizational efficiency. AR Assistant™ remittance processing will reduce your Days Sales Outstanding (DSO) by approximately 1 week, and improve your overall cash management.

ACI’s AR Assistant™ interfaces with any accounting system that has the ability to import and export data files.

AR Assistant™ handles the entire cash application process – including payment image & data capture, data validation & processing and relieving open invoices. AR Assistant™ also efficiently handles short payments and deductions

AR Assistant™ includes functionality that provides an easy way to apply deductions (short payments, rebates, discounts) and streamlines that data for cash application management. AR Assistant’s™ reporting modules also provide a complete overview of all deductions in one report eliminating the need for extensive analysis.

AR is typically the last communication your customers have with your company. When the payment process is fast, simple and stress free, AR staff are actually driving repeat sales and improving your customers’ experience.

Case Studies

Testimonials

"We’ve been using ACI’s services since 2011 when we made the decision to implement ACI’s AP Automation solution to streamline our Accounts Payable processes. ACI’s staff have always been very helpful and professional and they guided us through the implementation process every step of the way, making the transition smooth and painless. The success of this project made it easy to continue on our path to automation together with ACI and to implement their AR Automation solution for Cash Receipts. The time savings both in AP and AR have been significant and we love having our documents available at our fingertips! Their professional, friendly and knowledgeable team along with their intelligent business solutions have really made things easier for us! We highly recommend ACI.”

Kim StewartController CKF Inc.